Money management is a crucial skill set that is not covered in school (apparently learning about the mitochondria is more important). Thus, managing your finances might be challenging if you reach a stage in your life where money starts to flow seriously. Best for Habit Building of Personal Finance Software might be very helpful in this situation. You can maintain a budget, stay on top of your taxes, and keep an eye on your money with the help of these tools. Here is the Best for Habit Building of Personal Finance Software we highly recommend to you, YNAB. Let’s explored

An overview of YNAB- the Best for Habit Building of Personal Finance Software

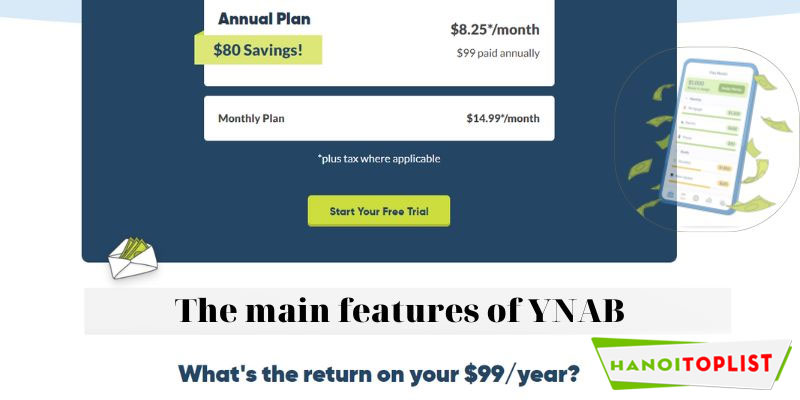

You Need A Budget is what YNAB stands for, not some lesser eldritch god. If you have a tendency to spend money whenever you feel like it, you may already be aware of the dangers of being careless with your money. Because of this, YNAB is designed for people who need to develop and, more importantly, maintain sound financial practices. There isn’t any sort of tiered structure in YNAB. There is only one product, and you can get it for either $84 per year (saving you $59 per year) or $11.99 per month. Both can be canceled whenever you want.

As suggested by its name, YNAB enables you to define financial objectives. Sharing these objectives with a spouse can help you hold each other accountable for saving money, keeping an eye on investments, and paying bills on time. It enables you to define financial objectives and celebrates success in achieving these objectives.

You will receive feedback on your progress in the form of numerous charts and graphs that can demonstrate how successfully you are managing to save money. Additionally, YNAB provides free online classes that will assist you in acquiring and maintaining sound money management techniques. It’s not the most feature-rich program on this list, but it’s extremely reasonably priced, will help you practice saving money, and maybe the excellent reviews of the app will inspire you to develop these habits permanently.

The main features of YNAB- the Best for Habit Building of Personal Finance Software

Budgeting is done proactively with YNAB. Setting goals, increasing spending, and modifying budgets are all actively done by app users. Although you can also make your own to suit your particular requirements, you start with basic budget categories. You can link a bank account to YNAB for automated import of transactions, although it’s not necessary. Remember that manually inputting transactions to your YNAB account could take a lot more time and work. YNAB is based on four distinct budgeting tenets:

- Put a job on every dollar. You allocate new revenue to certain categories or expenditures when it is added to YNAB.

- Accept your actual costs. You can set goals and make regular payments to pay off a one-time item that is not typically included in your budget, such as auto repairs.

- Take each blow as it comes. You can transfer money from one category to another if you go over budget in one.

- Money maturation. YNAB operates by funding your budget with earnings from the previous month.

- While YNAB allows you to establish categories within your budget for bills, it does not include an internal bill-paying option. You can only designate money for such expenses. If you pay for purchases with credit cards, you can create a credit card payment category and use it to filter money as you enter transactions from other categories. It is far more extensive than many other budgeting tools, so if it sounds like a lot of work, it is.

Security

Like the other personal financial programs I’ve studied, YNAB makes its whole security policy available to the public and guarantees to keep your information encrypted and private. The policy is strict, especially the clause stating that if you decide to quit using the service, your account will be fully deleted (some personal finance websites retain your data for a while even after you’ve stopped using them). It does not keep your bank credentials and employs encryption that is as least as good as that used by banks. YNAB has been in business since 2004; it is not a startup. The business also uses a variety of security measures, such as two-step verification.

Since my last evaluation, the account is now more easily accessible. YNAB collaborates with a number of businesses, including Plaid, that offers connectivity to your bank accounts. It’s an unusual feature for a personal finance solution to allow you to swap providers if you don’t like the one you initially choose.

Making Your Money Work

YNAB urges you to give every dollar a job starting with your income. Each dollar should be allocated to either savings or a category for consumption. Though a few dozen are offered to get you started, you spend a lot of time in the first few days deciding which categories you’ll need. Even a default “Stuff I Forgot to Budget For” category is provided by YNAB, which is helpful. Your categories may need some time to be finished, and they will probably keep changing as time passes.

Making sure that necessary costs are covered and that you aren’t overspending in any category is the goal of truly balancing your budget. YNAB aims to increase the awareness of income and expenses in people who live paycheck to paycheck by helping them understand where their money goes. Its creators desire that people live off of their monthly income without using additional dollars, and ideally even start saving.

Differentiating Qualities

Compared to other budgeting programs that are more “set it and forget it,” YNAB requires a little more effort and focus to understand. The good news is that YNAB doesn’t expect you to figure out how to use the Best for Habit Building of Personal Finance Software effectively on your own.

Additionally, your YNAB account grants you access to hundreds of weekly live courses that cover every facet of the Best for Habit Building of Personal Finance Software and how to create a budget using YNAB. A YNAB podcast, an online forum, and countless other useful resources are also available to help you get started and find answers to your questions.

Why YNAB is the Best for Habit Building of Personal Finance Software?

A great user experience is provided by YNAB, which improves usability and generally improves your experience. Once you comprehend them, their mechanics are not very difficult. Before you start anything, I urge you to look over some of the numerous lessons available, though once you begin going, there is a ton of support accessible (more on support later). YNAB is unique compared to every other budgeting tool I’ve ever used. It is very, very improbable that you could figure out its mechanism by simply clicking around.

I appreciate YNAB’s method. As I previously stated, it begins with your income and asks you to assign each dollar a task, such as saving money or paying bills. You begin with the funds you have available to you for the current month. Of course, there are some amounts that are set in stone, like your mortgage, rent, or auto payment. As with any budget, some of the others must be estimated.

Each category has a target amount that you may define by clicking on it and typing into the appropriate area in the right vertical window. Right up until you run out of categories, you keep entering targeted amounts. Prioritize your spending and may need to take money from another category of your budget if you run out of cash first.